When I team up with Becky at Planner Fun to offer free printables and new ways to use them, I am rarely stumped.

Usually, my problem is limiting myself to 6 ways to use the printable.

Showing posts with label budget. Show all posts

Showing posts with label budget. Show all posts

Monday, April 18, 2016

Thursday, April 14, 2016

Crazy Ways to Save Money

***This post may contain affiliate links. See my "Disclaimer" link for additional details.***

I try to be frugal, without sacrificing too much time or energy.

I try to be frugal, without sacrificing too much time or energy.

Monday, January 4, 2016

Setting Goals With a Planner

***This post may contain affiliate links. See my "Disclaimer" link for additional details.***

Unlike the New Year's Day resolutioners, I am constantly trying to lose weight (hello, roller coaster), budget responsibly, and exercise regularly.

For me, the resolution doesn't happen once a year on January 1st.

All year long, I am alone at the gym, working toward that goal.

Unlike the New Year's Day resolutioners, I am constantly trying to lose weight (hello, roller coaster), budget responsibly, and exercise regularly.

For me, the resolution doesn't happen once a year on January 1st.

All year long, I am alone at the gym, working toward that goal.

Monday, December 28, 2015

Top Ten Planner Posts of the Year: Post # 5

If you are thinking of setting some rules for keeping your planner easy-to-use in the new year, the #5 Giftie Top Ten post is a classic set of ideas for how to write in a planner.

Wednesday, December 23, 2015

Top Ten Planner Posts of the Year: Post # 7

As I continue to countdown the most popular planner posts from the last year, take a moment to schedule an hour or so to set up or tweak your 2016 planner using these tips.

All ten Top Ten posts will be available by New Year's Eve!

All ten Top Ten posts will be available by New Year's Eve!

Monday, November 16, 2015

Must Have Planner Accessories: You Don't Have to Spend Much

***This post may contain affiliate links. See my "Disclaimer" link for additional details.***

I constantly see pictures of people's HUGE planner stashes.

I constantly see pictures of people's HUGE planner stashes.

Monday, October 19, 2015

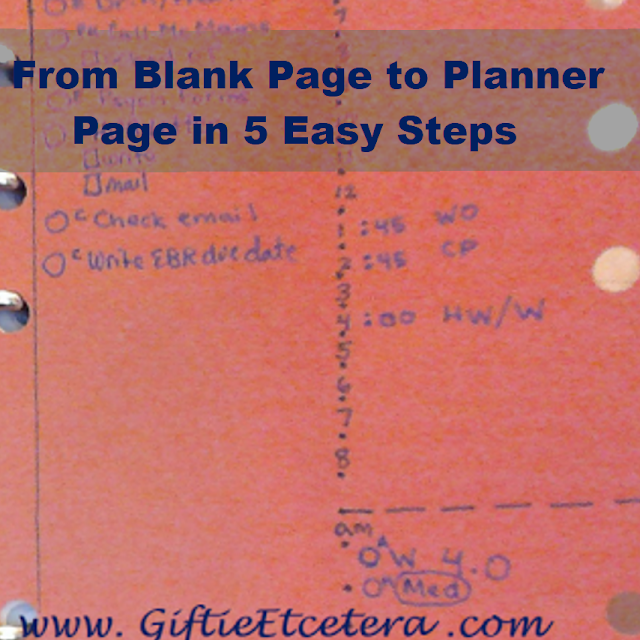

5 Easy Steps to Transform a Blank Page Into a Planner Page

As I write this, I'm thinking about tomorrow. It's going to be a Monday. I'm working on reducing stress, so having a plan to start the week is essential.

I often use pre-created daily forms of some sort, but I am not too uppity to just use blank paper!

I have five key steps that transform a page of blank paper into a form for making a schedule.

1. Double Hole Punch

Double hole punch the blank page, as I've explained before, so that the blank page can go on the side of the planner OPPOSITE tomorrow's weekly entry.

2. Fold in 1/2 (or in 1/4s or 1/3s)

Fold the page, keeping the edges even, to create straight lines.

TIP: Find a layout that you love on Pinterest and copy it by folding the page accordingly.

In the example below, I folded once in half, to make a vertical middle line. I dotted the line for my own visual help. Compare the middle, dotted line to the horrible hand drawn line on the left by the rings.

The folded, dotted line looks so much better!

3. Label

I labeled the upper right corner is the day/date, the times (6 a.m. to 9 a.m., right between the dots), a.m. specific tasks, p.m. specific tasks, and menu (all on the right).

The left column is for my tasks (from top to bottom) and my prep list (or things to bring out of the house with me, from bottom to top).

4. Add Monthlies

Monthlies hold my appointments. Obviously, they are the backbone of a daily plan for most people.

TIP: If you have very few appointments, choose a task-based layout instead of my appointment-based one.

Once I add appointments to the daily plan, I strike them out on the monthly calendar pages.

5. Add Weeklies

Weeklies contain my tasks. As I recopy them, I move any that are time-specific to my a.m. or p.m. list.

The best thing about this set-up?

I can change it EACH DAY to reflect my priorities and whether it is an appointment, task, or list heavy day!

For more great Giftie organizing and planning posts, make sure to follow me on Pinterest!

Etcetera.

If you enjoy what you read at Giftie Etcetera, please share on social media. Click here to join the Giftie Etcetera Facebook group.

I often use pre-created daily forms of some sort, but I am not too uppity to just use blank paper!

I have five key steps that transform a page of blank paper into a form for making a schedule.

1. Double Hole Punch

Double hole punch the blank page, as I've explained before, so that the blank page can go on the side of the planner OPPOSITE tomorrow's weekly entry.

2. Fold in 1/2 (or in 1/4s or 1/3s)

Fold the page, keeping the edges even, to create straight lines.

TIP: Find a layout that you love on Pinterest and copy it by folding the page accordingly.

In the example below, I folded once in half, to make a vertical middle line. I dotted the line for my own visual help. Compare the middle, dotted line to the horrible hand drawn line on the left by the rings.

The folded, dotted line looks so much better!

3. Label

I labeled the upper right corner is the day/date, the times (6 a.m. to 9 a.m., right between the dots), a.m. specific tasks, p.m. specific tasks, and menu (all on the right).

The left column is for my tasks (from top to bottom) and my prep list (or things to bring out of the house with me, from bottom to top).

4. Add Monthlies

Monthlies hold my appointments. Obviously, they are the backbone of a daily plan for most people.

TIP: If you have very few appointments, choose a task-based layout instead of my appointment-based one.

Once I add appointments to the daily plan, I strike them out on the monthly calendar pages.

5. Add Weeklies

Weeklies contain my tasks. As I recopy them, I move any that are time-specific to my a.m. or p.m. list.

The best thing about this set-up?

I can change it EACH DAY to reflect my priorities and whether it is an appointment, task, or list heavy day!

For more great Giftie organizing and planning posts, make sure to follow me on Pinterest!

Etcetera.

If you enjoy what you read at Giftie Etcetera, please share on social media. Click here to join the Giftie Etcetera Facebook group.

Sunday, October 4, 2015

Take Care of the Insides of Your Planner

Most people take care of the outsides of their planners - wiping them down, protecting them in bags, or treating leather.

But the insides of a planner are the important part!

What are you doing to care for those parts?

Check out this Classic Giftie post to find out how I care for the insides of my planner.

As always when I look back on a classic post, I update with things that I am currently doing. So, this morning, I read the old post and did the following:

*pulled out some projects that are complete and filed them away,

*filed away my September calendar pages, and

*created a task to redo my ABC Notes tabs, as they are worn out (and I don't have time to do it immediately).

Let me know in the comments what you did to care for the insides of your planner this week.

Etcetera.

If you enjoy what you read at Giftie Etcetera, please share on social media. Click here to join the Giftie Etcetera Facebook group.

Partied at: Happiness is Homemade, Simply Sundays, Inspiration Monday, Sundays Down Under, Mommy Monday, Manic Mondays, Monday Musings. Marvelous Monday, Something to Talk About, Anything Goes, Good Morning Mondays, Create Link Inspire, Roses of Inspiration, Country Fair Blog Party, Worthwhile Wednesdays, Wednesday Showcase, Link It To Me, A Little R and R, Wednesday's Wisdom, Way Back Wednesday, No Rules Weekend, Awesome Life Friday, Friday Features, Your Turn to Shine, Momma Told Me, Get Your Shine On, Weekend Blog Hop, Pretty Pintastic, Funtastic Friday, Reasons to Skip the Housework, Saturday Sharefest, My Favorite Things, Share the Wealth, Small Victories Sunday

But the insides of a planner are the important part!

What are you doing to care for those parts?

Check out this Classic Giftie post to find out how I care for the insides of my planner.

As always when I look back on a classic post, I update with things that I am currently doing. So, this morning, I read the old post and did the following:

*pulled out some projects that are complete and filed them away,

*filed away my September calendar pages, and

*created a task to redo my ABC Notes tabs, as they are worn out (and I don't have time to do it immediately).

Let me know in the comments what you did to care for the insides of your planner this week.

Etcetera.

If you enjoy what you read at Giftie Etcetera, please share on social media. Click here to join the Giftie Etcetera Facebook group.

Partied at: Happiness is Homemade, Simply Sundays, Inspiration Monday, Sundays Down Under, Mommy Monday, Manic Mondays, Monday Musings. Marvelous Monday, Something to Talk About, Anything Goes, Good Morning Mondays, Create Link Inspire, Roses of Inspiration, Country Fair Blog Party, Worthwhile Wednesdays, Wednesday Showcase, Link It To Me, A Little R and R, Wednesday's Wisdom, Way Back Wednesday, No Rules Weekend, Awesome Life Friday, Friday Features, Your Turn to Shine, Momma Told Me, Get Your Shine On, Weekend Blog Hop, Pretty Pintastic, Funtastic Friday, Reasons to Skip the Housework, Saturday Sharefest, My Favorite Things, Share the Wealth, Small Victories Sunday

Saturday, August 22, 2015

Cheaper to Eat at Home? Or on the Road?

I live in the suburbs, but my kids go to school in the city. Sometimes, especially if I run errands in the city in the middle of the day, I'm tempted to just eat out.

I have a list of inexpensive, diet-friendly foods that I order regularly in my planner, so I know where I can eat for under $5.

But I can make almost any meal at home for less than $5, so how do I know if I should go home to eat?

I've figured out a way to make the decision.

Confession: if you are still reading, you show know that today's calculation is based on Popeye's chicken tenders (man, that barbeque sauce is AMAZING) and NOT on the aforementioned healthy lunch!

Popeye's three chicken fingers (spicy, just the tenders please) cost $4.35 with tax in Baton Rouge, Louisiana.

(You are probably thinking, "how does she know that?" You should know that I am a big ole fat fatty piggy hog. That is how I know.)

Driving home to eat and back to town to pick up the kids cost...well, let's figure it out!

I rely on www.fueleconomy.gov to calculate the cost of gas. I just put in my starting point and destination address.

(Note that the website uses the national average cost of gas. I googled the cost in Baton Rouge and used that number instead.)

My 17 mile trip (times two because I have to go home and then come back to the city for afternoon carpool) costs $1.70 x 2 in gas, which equals $3.40.

TIP: Once you have calculated your normal cost, assuming gas prices stay relatively stable, you can write that number in your notes/file section of your planner and never calculate it again!

(You could also add in wear and tear on your vehicle, which the internet estimates at anywhere between $0.05 and $0.50 per mile, but I'll skip that part.)

$4.25 - $3.40 = $0.85, so the big question is whether I can eat at home for under $0.85.

Maybe, if I had red beans and rice or anything relatively cheap meal prepared. Instead, I have chicken breast tenders and some grilled veggies in the fridge, which costs about $2.00 to make.

So, for today only, I'll be eating Popeyes!

BUDGET TIP: If you know you will be staying in town, pack your lunch.

I don't always know if I will, but when I know it, I always pack my lunch.

Etcetera.

If you enjoy what you read at Giftie Etcetera, please share on social media. Click here to join the Giftie Etcetera Facebook group.

Partied at: Country Fair, Share the Wealth Sunday, Weekend Blog Hop, Tuesdays with a Twist

I have a list of inexpensive, diet-friendly foods that I order regularly in my planner, so I know where I can eat for under $5.

I've figured out a way to make the decision.

Confession: if you are still reading, you show know that today's calculation is based on Popeye's chicken tenders (man, that barbeque sauce is AMAZING) and NOT on the aforementioned healthy lunch!

Popeye's three chicken fingers (spicy, just the tenders please) cost $4.35 with tax in Baton Rouge, Louisiana.

(You are probably thinking, "how does she know that?" You should know that I am a big ole fat fatty piggy hog. That is how I know.)

Driving home to eat and back to town to pick up the kids cost...well, let's figure it out!

I rely on www.fueleconomy.gov to calculate the cost of gas. I just put in my starting point and destination address.

(Note that the website uses the national average cost of gas. I googled the cost in Baton Rouge and used that number instead.)

My 17 mile trip (times two because I have to go home and then come back to the city for afternoon carpool) costs $1.70 x 2 in gas, which equals $3.40.

TIP: Once you have calculated your normal cost, assuming gas prices stay relatively stable, you can write that number in your notes/file section of your planner and never calculate it again!

(You could also add in wear and tear on your vehicle, which the internet estimates at anywhere between $0.05 and $0.50 per mile, but I'll skip that part.)

$4.25 - $3.40 = $0.85, so the big question is whether I can eat at home for under $0.85.

Maybe, if I had red beans and rice or anything relatively cheap meal prepared. Instead, I have chicken breast tenders and some grilled veggies in the fridge, which costs about $2.00 to make.

So, for today only, I'll be eating Popeyes!

BUDGET TIP: If you know you will be staying in town, pack your lunch.

I don't always know if I will, but when I know it, I always pack my lunch.

Etcetera.

If you enjoy what you read at Giftie Etcetera, please share on social media. Click here to join the Giftie Etcetera Facebook group.

Partied at: Country Fair, Share the Wealth Sunday, Weekend Blog Hop, Tuesdays with a Twist

Thursday, August 13, 2015

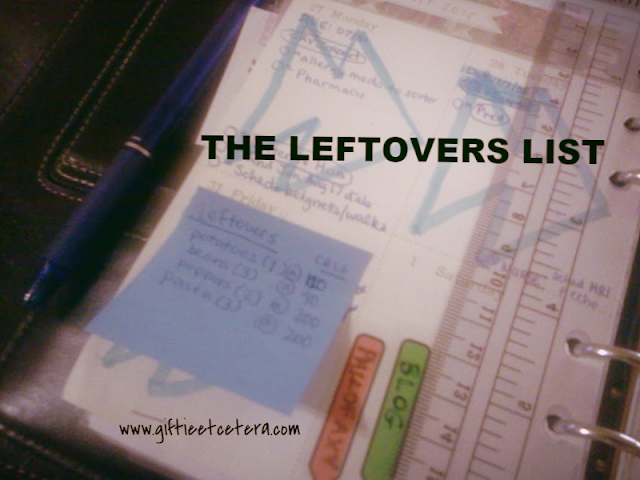

How One Simple List Can Reduce Food Waste

I've found a simple solution (in my planner, of course) to prevent food waste, save time, and help me stay on the weight loss track.

One simple list can make sure that leftovers don't get thrown away!

I jot a list on a post-it of any leftovers that are on the leftover shelf in fridge.

TIP: Create a designated shelf for foods that are leftover or must be used quickly.

I just move the list from week-to-week in my planner and use it to meal plan each night.

TIP: Note the number of servings left and the number of calories, and you are all set for weight loss.

If you enjoyed this simple tip, please share in your social media circles!

Etcetera.

Partied at: This Is How We Roll, Thoughtful Thursday, Pintastic Pinteresting, Home Matters, Share the Wealth

One simple list can make sure that leftovers don't get thrown away!

I jot a list on a post-it of any leftovers that are on the leftover shelf in fridge.

TIP: Create a designated shelf for foods that are leftover or must be used quickly.

I just move the list from week-to-week in my planner and use it to meal plan each night.

TIP: Note the number of servings left and the number of calories, and you are all set for weight loss.

If you enjoyed this simple tip, please share in your social media circles!

Etcetera.

Partied at: This Is How We Roll, Thoughtful Thursday, Pintastic Pinteresting, Home Matters, Share the Wealth

Tuesday, June 9, 2015

How I Discovered That I'm Not a Free Range Parent

Last year, Santa brought The Loki (age 6) and The Ander (age 9) bicycles for Christmas. My husband and I tried to teach them to ride. There were tears. There were screams. There were injuries. There was drama.

The kids also expressed their displeasure with the whole process.

So, last week, I brought them to physical therapists, paid over $500, and let the experts teach my uncoordinated kids - with their complete lack of fine and large motor skills - to ride two-wheeled bikes. (Don't judge! Okay, fine, judge. But just know it was worth EVERY SINGLE PENNY.)

It worked. We have (insanely expensive) bike riders!

After assessing their progress, the younger child got limits. He has epilepsy, so he cannot ride without a buddy along. He must ask first. No in the road yet without an adult, since he ignores cars. (Thankfully, we live at the end of a dead end road with almost no traffic.) He can only ride to and from the dead end and back to our house.

The epilepsy diagnosis made these rules reasonable.

But the older kid is riding so well and watching for cars, so he got different limits. He can go halfway up and down the street (still only about 0.2 miles), visit with neighbor kids in the front yard only, and go out by himself as long as he tells me he is going outside.

I watched him test the rules. He followed them closely. He is a very responsible, obedient kid.

Watching him, always in view of my house, freaked me out.

I thought I'd be the cool parent. "Ride to the park," I'd say. "Be inside before the streetlights," I'd urged. And then I would disappear, to take a nap or watch Netflix without a care.

Instead, I'm ruining my blinds trying to peek out the window. I'm thinking of setting the alarm on his watch for him to check back every15 10 2 minutes.

Instead of allowing him to roam the neighborhood and explore, like I did as a kid, I want to tie him to the house.

Instead of free range parenting, which sounds deliciously compelling in theory, I want to helicopter parent. My nature screams for it.

It will get better with time, right? In the meantime, how upset would my husband be if I cut a peephole into the window shades?

Etcetera.

Partied at: Thoughtful Thursdays, Pintastic Pinteresting

The kids also expressed their displeasure with the whole process.

So, last week, I brought them to physical therapists, paid over $500, and let the experts teach my uncoordinated kids - with their complete lack of fine and large motor skills - to ride two-wheeled bikes. (Don't judge! Okay, fine, judge. But just know it was worth EVERY SINGLE PENNY.)

It worked. We have (insanely expensive) bike riders!

After assessing their progress, the younger child got limits. He has epilepsy, so he cannot ride without a buddy along. He must ask first. No in the road yet without an adult, since he ignores cars. (Thankfully, we live at the end of a dead end road with almost no traffic.) He can only ride to and from the dead end and back to our house.

The epilepsy diagnosis made these rules reasonable.

But the older kid is riding so well and watching for cars, so he got different limits. He can go halfway up and down the street (still only about 0.2 miles), visit with neighbor kids in the front yard only, and go out by himself as long as he tells me he is going outside.

I watched him test the rules. He followed them closely. He is a very responsible, obedient kid.

Watching him, always in view of my house, freaked me out.

I thought I'd be the cool parent. "Ride to the park," I'd say. "Be inside before the streetlights," I'd urged. And then I would disappear, to take a nap or watch Netflix without a care.

Instead, I'm ruining my blinds trying to peek out the window. I'm thinking of setting the alarm on his watch for him to check back every

Instead of allowing him to roam the neighborhood and explore, like I did as a kid, I want to tie him to the house.

Instead of free range parenting, which sounds deliciously compelling in theory, I want to helicopter parent. My nature screams for it.

It will get better with time, right? In the meantime, how upset would my husband be if I cut a peephole into the window shades?

Etcetera.

Partied at: Thoughtful Thursdays, Pintastic Pinteresting

Tuesday, June 2, 2015

Why Spending More on Groceries Is Good for Your Budget

I am as obsessed as most homemakers with budgeting blogs. I watch people coupon and spend $200 a month on groceries - and I imagine doing the same thing.

I could bake all my bread from scratch! Casseroles, pasta, rice...I could totally do that. Homemade lemonade and making my own cheese? Sure.

Ha ha ha ha ha ha ha! That is so not happening. I couldn't even stick to couponing.

Instead, I spend about $150 a week on groceries for a family of four.

Why so much?

I could bake all my bread from scratch! Casseroles, pasta, rice...I could totally do that. Homemade lemonade and making my own cheese? Sure.

Ha ha ha ha ha ha ha! That is so not happening. I couldn't even stick to couponing.

Why so much?

First, it's not that much. $150 divided by seven days equals about $22 a day. Divide that by four, and we are spending about $5.36 per person per day on food.

Try eating out for $5.36. It is impossible.

Second, I tracked our eating habits over the years. $150 is a good balance for our family.

If we spend $200 a week on food, we still eat out once or twice a week, and we waste food in the fridge.

If we spend $120 a week on food (something we tried), we run out of new stuff to eat in about five days and eat out even more. (I've already established that we cannot eat out for $5.36 per person per day.)

Third, we eat healthier at the $150 per week mark.

I can splurge on lots of fruit and veggies. I can afford to add black beans to the chili and enchiladas. And we can get an indulgence or two (like some frozen yogurt and ice cream cones or the perfect ranch dressing for dipping homemade buffalo chicken strips) to make our eating plan more exciting.

We do live in a low cost area and have access to an excellent, inexpensive produce stand. Also, this $150 includes at least one quick meal (say, rotisserie chicken) on grocery night.

I tracked our spending on Spending Tracking (an app from Microsoft) and when we spend about $150 per week on food, we eat out less often and save significant amounts of money from our total food budget (groceries plus eating out) compared to our $120 a month days) of about $400 per month!

If I am very careful (freezing leftovers, cooking regularly with a menu plan, and stocking up on sale staple products), we can get away with a budget of $140.

My formula for a good grocery budget:

($5 x the # of people x 7) + $10 for luxury/treat items = YOUR BUDGET

For us:

($5 x 4 x 7) + $10 =

($20 x 7) + $10 =

($140) + $10 = $150

Try eating out for $5.36. It is impossible.

Second, I tracked our eating habits over the years. $150 is a good balance for our family.

If we spend $200 a week on food, we still eat out once or twice a week, and we waste food in the fridge.

If we spend $120 a week on food (something we tried), we run out of new stuff to eat in about five days and eat out even more. (I've already established that we cannot eat out for $5.36 per person per day.)

Third, we eat healthier at the $150 per week mark.

I can splurge on lots of fruit and veggies. I can afford to add black beans to the chili and enchiladas. And we can get an indulgence or two (like some frozen yogurt and ice cream cones or the perfect ranch dressing for dipping homemade buffalo chicken strips) to make our eating plan more exciting.

We do live in a low cost area and have access to an excellent, inexpensive produce stand. Also, this $150 includes at least one quick meal (say, rotisserie chicken) on grocery night.

I tracked our spending on Spending Tracking (an app from Microsoft) and when we spend about $150 per week on food, we eat out less often and save significant amounts of money from our total food budget (groceries plus eating out) compared to our $120 a month days) of about $400 per month!

If I am very careful (freezing leftovers, cooking regularly with a menu plan, and stocking up on sale staple products), we can get away with a budget of $140.

My formula for a good grocery budget:

($5 x the # of people x 7) + $10 for luxury/treat items = YOUR BUDGET

For us:

($5 x 4 x 7) + $10 =

($20 x 7) + $10 =

($140) + $10 = $150

Try it! A $150 budget (or the equivalent for your family) might actually save you money overall.

Join us in our Facebook group to talk about organizing, planning, productivity, budgeting, and anything else that puts your life in order by clicking on Etcetera below!

Etcetera.

Join us in our Facebook group to talk about organizing, planning, productivity, budgeting, and anything else that puts your life in order by clicking on Etcetera below!

Etcetera.

Thursday, April 30, 2015

How to Be a Frugal Foodie Without Sacrificing Yummy Food

If you love food, you don't have to sacrifice yummy flavor to be frugal and save money. Just follow these simple hints.

*Don't let leftovers linger.

To save time, definitely cook extra for leftovers.

EXCEPTION: Don't make leftovers of something that does not warm up well. Just make a single serving for each family member of meat that is not in a sauce that would keep it moist, for example.

But make sure that you eat leftovers only once, preferably the next day. Otherwise, your family will get bored and start complaining that they hate leftovers.

TIP: Write a reminder in your planner when you cook a large meal to "freeze leftovers" the next day.

*Recreate leftovers as frozen dinners (or lunches).

TIP: Freeze as individual servings.

I rarely freeze leftovers in one big ziploc bag. Instead, I make several individual servings. Grab one to throw in your lunchbox. Grab three for a quick dinner. Grab one or two as a side item to go with a grilled meat. The smaller servings defrost easily in a microwave or on the stove.

Leftovers are way tastier than most frozen meals, generally cheaper, and quick to heat up. By doing individual servings, each person can choose their favorite meal to heat up on leftovers night!

*Use fruits, veggies, and meats before the natural deadline.

FYI: Natural deadline = rotting food. Avoid that!

TIP: Write a note to eat the foods tomorrow in your planner.

TIP: Use as side dishes or snacks.

*Freeze fruits and veggies during the peak season, when they are cheapest and freshest.

TIP: Prepare them for cooking first.

Strawberries are cut into blender sized chunks. Jalapenos are pre-chopped for salsa or sliced for omelets. Some peppers are diced, while others are sliced.

*Mix and match leftovers with fresh foods.

I make a mean enchilada casserole. It's fine leftover, but adding a side of freshly cooked saffron rice makes my family forget that it is leftover.

*Use expensive condiments.

If I am serving an apple, my kids are not impressed. But slice an apple and drizzle a bit of honey and cinnamon? Dessert.

Some cheese that won't be good soon? Use some very aged balsamic vinegar. It doesn't take much to make any cheese pop with flavor.

You saw that instead of plain white rice, we often go for saffron rice.

Expensive condiments go on the side, but there is nothing like them for cheaply (because you don't use much) upgrading food.

Share with your budget-conscious, foodie friends!

Etcetera.

Linked at:

*Don't let leftovers linger.

To save time, definitely cook extra for leftovers.

EXCEPTION: Don't make leftovers of something that does not warm up well. Just make a single serving for each family member of meat that is not in a sauce that would keep it moist, for example.

But make sure that you eat leftovers only once, preferably the next day. Otherwise, your family will get bored and start complaining that they hate leftovers.

TIP: Write a reminder in your planner when you cook a large meal to "freeze leftovers" the next day.

*Recreate leftovers as frozen dinners (or lunches).

TIP: Freeze as individual servings.

I rarely freeze leftovers in one big ziploc bag. Instead, I make several individual servings. Grab one to throw in your lunchbox. Grab three for a quick dinner. Grab one or two as a side item to go with a grilled meat. The smaller servings defrost easily in a microwave or on the stove.

Leftovers are way tastier than most frozen meals, generally cheaper, and quick to heat up. By doing individual servings, each person can choose their favorite meal to heat up on leftovers night!

*Use fruits, veggies, and meats before the natural deadline.

FYI: Natural deadline = rotting food. Avoid that!

TIP: Write a note to eat the foods tomorrow in your planner.

TIP: Use as side dishes or snacks.

*Freeze fruits and veggies during the peak season, when they are cheapest and freshest.

TIP: Prepare them for cooking first.

Strawberries are cut into blender sized chunks. Jalapenos are pre-chopped for salsa or sliced for omelets. Some peppers are diced, while others are sliced.

*Mix and match leftovers with fresh foods.

I make a mean enchilada casserole. It's fine leftover, but adding a side of freshly cooked saffron rice makes my family forget that it is leftover.

*Use expensive condiments.

If I am serving an apple, my kids are not impressed. But slice an apple and drizzle a bit of honey and cinnamon? Dessert.

Some cheese that won't be good soon? Use some very aged balsamic vinegar. It doesn't take much to make any cheese pop with flavor.

You saw that instead of plain white rice, we often go for saffron rice.

Expensive condiments go on the side, but there is nothing like them for cheaply (because you don't use much) upgrading food.

Share with your budget-conscious, foodie friends!

Etcetera.

Linked at:

Thursday, April 23, 2015

Save Money and Time: The Duplicate Secret

I've discovered a simple way to save time, money, and space in my home.

Whenever I get samples or extras of something, I store it with the main item. Then, when I go to use something (say the sample toothpaste above that my dentist gave to me), I use the smaller product first.

TIP: Use the smaller amount of anything (toothpaste, soap, food) first!

It sounds silly, but it means that I don't have to store all those tiny soaps or shampoos forever, in case I use them later. I am using them - right now. I use them right away, then go back to my favorite brand of soap.

It saves money because I buy less of those things and can, at a glance, keep track of how much I have on hand and avoid overbuying. It saves time, both shopping time and time finding more toothpaste. Not having too many duplicates also saves space.

(Obviously, there are exceptions. I buy my toilet paper in bulk and on sale, so other than the roll by the toilet, I have a special place to store all of it.)

Etcetera.

Linked at:

Whenever I get samples or extras of something, I store it with the main item. Then, when I go to use something (say the sample toothpaste above that my dentist gave to me), I use the smaller product first.

TIP: Use the smaller amount of anything (toothpaste, soap, food) first!

It sounds silly, but it means that I don't have to store all those tiny soaps or shampoos forever, in case I use them later. I am using them - right now. I use them right away, then go back to my favorite brand of soap.

It saves money because I buy less of those things and can, at a glance, keep track of how much I have on hand and avoid overbuying. It saves time, both shopping time and time finding more toothpaste. Not having too many duplicates also saves space.

(Obviously, there are exceptions. I buy my toilet paper in bulk and on sale, so other than the roll by the toilet, I have a special place to store all of it.)

Etcetera.

Linked at:

Thursday, April 2, 2015

10 Steps to Organize and Simplify Your Shoe Collection

I counted my shoes. Guess how many pairs of shoes I own?

40.

Surely it is not a coincidence that I have 40 shoes during the Lenten season, right? That's how I justify 40 shoes. Biblical significance. It's what God wants, right?

Truly, nobody needs 40 pairs of shoes. So I decided to cull my collection, simplify my shoe choices, and organize what was left.

Here's my step-by-step process, so that you can do the same at your home.

1. Pull all the shoes out of the closet.

I know that seems overwhelming, but it is only 40 things or less, right? (And let's face it - if your shoe problem is bigger than mine, you really NEED to do this.)

2. Put any broken or unusable shoes in the trash.

People tell me that shoes can be fixed. If you've ever done that, good for you! For the rest of us, we need to be honest with ourselves and just toss the shoes.

3. Put any shoes that fit poorly or that are never worn in the donate bag.

I have a bag for donations next to my washer and dryer at all times. It's just a garbage can lined with a trash bag.

Personally, I never wear shoes with bows or black heels. So why did I own 6 pairs of those?

4. Match up all other shoes by style.

I had a few categories:

*boots

*running/walking

*fancy flip flops/flat sandals

*wedge sandals

*flats

*heels/wedges

*special shoes (like my rubber swim flip flops, slippers, and water shoes)

5. Discard the least favorite of any color duplicates.

In each category, consider whether your have too many of a certain style or color.

I had two pairs of brown boots. Only my favorite stayed.

I had three shoes in a camel color. I kept two (a strappy wedge sandal and a regular wedge). I love all three, but honestly only wear the two, since I love one of the wedges more than the other and they coordinated with all the same clothes.

6. Don't toss something that is worn regularly with a specific outfit.

My water shoes are only worn about once every two years, if we hit a beach during vacation. But it would be silly to toss them only to buy news ones each time I go to a beach!

7. Use a fancy shoe holder or dedicated shelf or drawer for fancy shoes.

Designate any space that is a crush-free zone for fancy shoes. These are the shoes that you probably can hide away, as they are for dressing up or go with specific outfits, so don't discount a shallow drawer or the coat closet.

8. Use bins for sturdy shoes, a hanging shoe organizer for flip flops and flat sandals, and a hanging sweater organizer for athletic shoes.

My bins are sorted by color: camel, red family, and brown.

A hanging shoe organizer (shown in the sidebar under "Stuff Mentioned") fits flip flops and flat sandals well, but I need the deeper sweater organizer for boots and athletic shoes.

9. Learn from yourself.

I learned that I HATE black and brown shoes. I prefer natural, camel, silver, or deep reddish shoes. And since those are mostly neutral colors, they go with everything!

(Seriously, try on some camel shoes with your black pants. They pop with style!)

Now that I know my style and what I actually wear, I can shop for comfort and quality. I also don't need a camel-colored shoe. I have two great pairs.

10. Have a one in/one out policy.

If I buy a new pair of shoes, a pair has to go.

I started with 40 pairs of shoes. I am down to 22 (including my water shoes, shower flip flops, and slippers).

How did you do? Let us know!

Etcetera.

Linked at:

40.

Surely it is not a coincidence that I have 40 shoes during the Lenten season, right? That's how I justify 40 shoes. Biblical significance. It's what God wants, right?

Truly, nobody needs 40 pairs of shoes. So I decided to cull my collection, simplify my shoe choices, and organize what was left.

Here's my step-by-step process, so that you can do the same at your home.

1. Pull all the shoes out of the closet.

I know that seems overwhelming, but it is only 40 things or less, right? (And let's face it - if your shoe problem is bigger than mine, you really NEED to do this.)

2. Put any broken or unusable shoes in the trash.

People tell me that shoes can be fixed. If you've ever done that, good for you! For the rest of us, we need to be honest with ourselves and just toss the shoes.

3. Put any shoes that fit poorly or that are never worn in the donate bag.

I have a bag for donations next to my washer and dryer at all times. It's just a garbage can lined with a trash bag.

Personally, I never wear shoes with bows or black heels. So why did I own 6 pairs of those?

4. Match up all other shoes by style.

I had a few categories:

*boots

*running/walking

*fancy flip flops/flat sandals

*wedge sandals

*flats

*heels/wedges

*special shoes (like my rubber swim flip flops, slippers, and water shoes)

5. Discard the least favorite of any color duplicates.

In each category, consider whether your have too many of a certain style or color.

I had two pairs of brown boots. Only my favorite stayed.

I had three shoes in a camel color. I kept two (a strappy wedge sandal and a regular wedge). I love all three, but honestly only wear the two, since I love one of the wedges more than the other and they coordinated with all the same clothes.

6. Don't toss something that is worn regularly with a specific outfit.

My water shoes are only worn about once every two years, if we hit a beach during vacation. But it would be silly to toss them only to buy news ones each time I go to a beach!

7. Use a fancy shoe holder or dedicated shelf or drawer for fancy shoes.

Designate any space that is a crush-free zone for fancy shoes. These are the shoes that you probably can hide away, as they are for dressing up or go with specific outfits, so don't discount a shallow drawer or the coat closet.

8. Use bins for sturdy shoes, a hanging shoe organizer for flip flops and flat sandals, and a hanging sweater organizer for athletic shoes.

My bins are sorted by color: camel, red family, and brown.

A hanging shoe organizer (shown in the sidebar under "Stuff Mentioned") fits flip flops and flat sandals well, but I need the deeper sweater organizer for boots and athletic shoes.

9. Learn from yourself.

I learned that I HATE black and brown shoes. I prefer natural, camel, silver, or deep reddish shoes. And since those are mostly neutral colors, they go with everything!

(Seriously, try on some camel shoes with your black pants. They pop with style!)

Now that I know my style and what I actually wear, I can shop for comfort and quality. I also don't need a camel-colored shoe. I have two great pairs.

10. Have a one in/one out policy.

If I buy a new pair of shoes, a pair has to go.

I started with 40 pairs of shoes. I am down to 22 (including my water shoes, shower flip flops, and slippers).

How did you do? Let us know!

Etcetera.

Linked at:

Thursday, March 26, 2015

Save Money and Time: The Dots and Stars Grocery List Trick

There are so many ways to create a grocery list. Many folks use a master list. Some people check the pantry and refrigerator or work from a menu plan.

Those techniques are perfectly valid. I've used many of them myself.

But I am doing something so much simpler these days, that is both working effectively so that I don't run out of food and saving me money.

I called my grocery list trick Dots and Stars.

As I run low on an item, I add it to my grocery list. My family does the same. Even my six year old knows that if you don't put cereal on the list, you eat toast for the next week.

After I make a weekly menu, I add food from the menu that is not on hand to my grocery list.

When I look at the sales flyer or coupons about to expire for things that I buy anyway, I add those items to my grocery list.

If you use a master list, you can just check these same things off on the master list.

As I do those additions to the grocery, I employ the Dots and Stars technique.

Dots: Dots go next to items that I will need, but can afford to wait on until they go on sale. These items will eventually become stars or undesignated, but they are extremely flexible right now.

For example, I just opened my last pack of razors. I can wait a while to get razors, but definitely want more when they go on sale.

I also just finished all the ice cream in the house. Ice cream is a treat and only purchased when it goes on sale, so as I finish the product, it goes on the list with a dot.

TIP: Get into the habit of marking any item on your planner's list as you run out of it.

Stars: Stars go next to items that I need to buy this week, no matter the cost. These items are not flexible, and must be purchased.

For example, milk and bread almost always get stars. In addition, if I volunteered to make brownies for the school bake sale and have none on hand, brownies go on the list. Diapers would go on this list.

No Designation: Most items don't get a designation. That means I buy them if they are reasonably priced or substitute in something that is reasonably priced. These items are somewhat flexible.

For example, apples might go on the list. But if apples are not cheap enough, I might end up buying bananas instead.

I might have a lot of hamburger meat in the freezer and plan to make an enchilada casserole. But if the peppers look iffy and hamburger buns are on sale, we might make cheeseburgers instead.

Just like using a planner to make decisions on the front end, this sort of grocery list lets me make some decisions (dots - defer until on sale; stars - buy this week) on the front end, and lets me know what decisions to make when in the store and faced with more information about price and quality.

Front end decisions save time, money, and stress in the grocery store and in life!

Etcetera.

Linked at:

Those techniques are perfectly valid. I've used many of them myself.

But I am doing something so much simpler these days, that is both working effectively so that I don't run out of food and saving me money.

I called my grocery list trick Dots and Stars.

As I run low on an item, I add it to my grocery list. My family does the same. Even my six year old knows that if you don't put cereal on the list, you eat toast for the next week.

After I make a weekly menu, I add food from the menu that is not on hand to my grocery list.

When I look at the sales flyer or coupons about to expire for things that I buy anyway, I add those items to my grocery list.

If you use a master list, you can just check these same things off on the master list.

As I do those additions to the grocery, I employ the Dots and Stars technique.

Dots: Dots go next to items that I will need, but can afford to wait on until they go on sale. These items will eventually become stars or undesignated, but they are extremely flexible right now.

For example, I just opened my last pack of razors. I can wait a while to get razors, but definitely want more when they go on sale.

I also just finished all the ice cream in the house. Ice cream is a treat and only purchased when it goes on sale, so as I finish the product, it goes on the list with a dot.

TIP: Get into the habit of marking any item on your planner's list as you run out of it.

Stars: Stars go next to items that I need to buy this week, no matter the cost. These items are not flexible, and must be purchased.

For example, milk and bread almost always get stars. In addition, if I volunteered to make brownies for the school bake sale and have none on hand, brownies go on the list. Diapers would go on this list.

No Designation: Most items don't get a designation. That means I buy them if they are reasonably priced or substitute in something that is reasonably priced. These items are somewhat flexible.

For example, apples might go on the list. But if apples are not cheap enough, I might end up buying bananas instead.

I might have a lot of hamburger meat in the freezer and plan to make an enchilada casserole. But if the peppers look iffy and hamburger buns are on sale, we might make cheeseburgers instead.

Just like using a planner to make decisions on the front end, this sort of grocery list lets me make some decisions (dots - defer until on sale; stars - buy this week) on the front end, and lets me know what decisions to make when in the store and faced with more information about price and quality.

Front end decisions save time, money, and stress in the grocery store and in life!

Etcetera.

Linked at:

Saturday, February 21, 2015

The Best Budgeting Tools

Most people don't have the proper tools for budgeting. Having less-than-superior tools can make it hard to keep track of what is spent every month. What are the proper tools?

Mason Jar

I like this big mason jar for receipts. It's clear, so I cannot ignore that I haven't processed them yet.

Budget Application

I have an app that works well for me (Spending Tracker) on my Surface Pro 3. The key, for me, is very simple-to-use budgeting programs (or I don't use them) and a fun, portable laptop.

Laptop

Now, if you are a Loyal Reader, you know that I used to use pen and paper to budget and that I almost always prefer writing. So why the technological solution?

Well, first, math.

I like the computer to do the math for me. Ironically, I'm excellent at algebra and trig, and horrible at arithmetic.

Second, I prefer the graphs that computers can do over the thousand pieces of paper for discerning how I am spending my money.

Third, I don't have to file thousands of pieces of paper! My Surface keeps track of the numbers for me.

The most important reason that I don't write my budget in my planner, though, is because I don't need to make decisions on the front end (those are made at a meeting with my husband) and I don't need to remember the information. If I did, I would use paper. I only need the running tally of the number, which the computer communicates quite well.

I am a big fan of a paper planner. But, sometimes, another tool is better.

For budgets, try a glass jar and a great laptop.

Etcetera.

Mason Jar

I like this big mason jar for receipts. It's clear, so I cannot ignore that I haven't processed them yet.

Budget Application

I have an app that works well for me (Spending Tracker) on my Surface Pro 3. The key, for me, is very simple-to-use budgeting programs (or I don't use them) and a fun, portable laptop.

Laptop

Now, if you are a Loyal Reader, you know that I used to use pen and paper to budget and that I almost always prefer writing. So why the technological solution?

Well, first, math.

I like the computer to do the math for me. Ironically, I'm excellent at algebra and trig, and horrible at arithmetic.

Second, I prefer the graphs that computers can do over the thousand pieces of paper for discerning how I am spending my money.

Third, I don't have to file thousands of pieces of paper! My Surface keeps track of the numbers for me.

The most important reason that I don't write my budget in my planner, though, is because I don't need to make decisions on the front end (those are made at a meeting with my husband) and I don't need to remember the information. If I did, I would use paper. I only need the running tally of the number, which the computer communicates quite well.

I am a big fan of a paper planner. But, sometimes, another tool is better.

For budgets, try a glass jar and a great laptop.

Etcetera.

Sunday, February 8, 2015

7 Things That You Aren't Writing Down

For today's Sunday flashback post, I chose 7 Things That You Aren't Writing Down, But Should. It's worth clicking on the link and reading the post!

The surprising thing about this post? Even though I have moved to digital planning for work, I'm still writing down most of the things that I suggested.

The only one that I am not writing down? The kids' homework. The older kid is in third grade and has straight As, so homework is his problem (at least until grades drop). The younger kid gets a paper handout, so that works for me!

Etcetera.

The surprising thing about this post? Even though I have moved to digital planning for work, I'm still writing down most of the things that I suggested.

The only one that I am not writing down? The kids' homework. The older kid is in third grade and has straight As, so homework is his problem (at least until grades drop). The younger kid gets a paper handout, so that works for me!

Etcetera.

Saturday, January 24, 2015

5 Simple Ways to Conquer Receipts

Receipts are a constant problem in the fight against clutter.

There are five simple things that work for me to conquer the receipt piles.

1. Assign Designated Place for Receipts

2. Track the Budget

On one hand, these tiny pieces of paper are important for budgeting, tax preparation, and store returns.

On the other hand, some are useless and they don't fit in your planner, letter-sized (standard) folders, or boxes in an easy-to-organize way.

There are five simple things that work for me to conquer the receipt piles.

1. Assign Designated Place for Receipts

On the go, I have a special place in my wallet for receipts. It's even labeled.

At home, those receipts go from my wallet to a large Mason jar on my desk for processing.

I've made transferring receipts from my wallet to my jar a routine habit at the end of the work day, but if I forget, I at least do it when I unload groceries, about once a week.

TIP: Associate transferring receipts with something you do anyway. For me, I plug in my cell phone and clean out my receipt wallet. I unload groceries and clean out my receipt wallet. Through repetition, those things are so well associated with each other that I do them automatically.

At home, those receipts go from my wallet to a large Mason jar on my desk for processing.

I've made transferring receipts from my wallet to my jar a routine habit at the end of the work day, but if I forget, I at least do it when I unload groceries, about once a week.

TIP: Associate transferring receipts with something you do anyway. For me, I plug in my cell phone and clean out my receipt wallet. I unload groceries and clean out my receipt wallet. Through repetition, those things are so well associated with each other that I do them automatically.

2. Track the Budget

Either download an application (I use Spending Tracker, a free application), create a checkbook register page in your planner, or create a simple Excel spreadsheet to track your spending.

I like Spending Tracker because it is so easy to use. (No, they are not paying me to say this, though I would not say no if they sent me money.)

TIP: Too lazy or overwhelmed to create a checkbook register? Pick up an extra register from your bank and use it to track all income and expenses!

3. Record Spending at Least Once per Week

I like Spending Tracker because it is so easy to use. (No, they are not paying me to say this, though I would not say no if they sent me money.)

TIP: Too lazy or overwhelmed to create a checkbook register? Pick up an extra register from your bank and use it to track all income and expenses!

3. Record Spending at Least Once per Week

In my planner, there is a task scheduled to go through receipts at least weekly.

I like to do it on Friday mornings over coffee.

4. Sort the Receipts

I like to do it on Friday mornings over coffee.

As I record, I sort the receipts into three stacks.

*TRASH

Trash gets crumbled into a ball after I enter them in the budget software. Most receipts are trash.

*LONG TERM

Long term receipts are special and you definitely know them when you see them. They are generally receipts that are being saved for a tax deduction (in any amount) or receipts for expensive products, usually over $100, with a lifespan longer than a year (like my refrigerator).

*SHORT TERM

*TRASH

Trash gets crumbled into a ball after I enter them in the budget software. Most receipts are trash.

*LONG TERM

Long term receipts are special and you definitely know them when you see them. They are generally receipts that are being saved for a tax deduction (in any amount) or receipts for expensive products, usually over $100, with a lifespan longer than a year (like my refrigerator).

*SHORT TERM

Short term receipts, in my home, are receipts for over $100 (like my weekly Target shopping) and receipts for individual items worth over $10 (like a receipt with a $30 sweater on it).

For some examples of how I decide which receipts to keep, hop over to this You Tube video.

5. File Receipts

I file receipts in a large index card box.

Each month, I empty out the short term receipts from last year and put the new ones behind the current month.

For some examples of how I decide which receipts to keep, hop over to this You Tube video.

5. File Receipts

I file receipts in a large index card box.

Each month, I empty out the short term receipts from last year and put the new ones behind the current month.

This method means that I never have a backlog of old receipts from many years in the past.

Tuesday, January 20, 2015

How to Write a Better Grocery List

Writing a grocery list is easy.

Milk

Eggs

Bread

(Am I the only person who only buys eggs about once every two months? I hate baking!)

Writing an effective grocery list is hard.

An effective grocery list includes everything that I need, a couple of things that I want, and nothing else. It is organized by aisle and does not require me to double-back or, worse, to return to the store later in the week.

There are many tricks that I use to write a better grocery list.

Assign a Dedicated Place in the Planner

My grocery list goes in my planner right behind my sticky note dashboard. It needs to be very accessible, since items are so often added during the dinner cooking crazy hour.

Having a dedicated space for a shopping list is so much better than sticky notes or torn slips of paper all over the house.

Have a Standard Layout

Milk

Eggs

Bread

(Am I the only person who only buys eggs about once every two months? I hate baking!)

Writing an effective grocery list is hard.

An effective grocery list includes everything that I need, a couple of things that I want, and nothing else. It is organized by aisle and does not require me to double-back or, worse, to return to the store later in the week.

There are many tricks that I use to write a better grocery list.

My grocery list goes in my planner right behind my sticky note dashboard. It needs to be very accessible, since items are so often added during the dinner cooking crazy hour.

Having a dedicated space for a shopping list is so much better than sticky notes or torn slips of paper all over the house.

Have a Standard Layout

My layout is pretty much the same for each week's shopping list. It reflects the layout of the store.

CHECKLIST - DATES - PRESCRIPTIONS

NONFOOD - FROZEN FOOD

FOOD - COLD FOOD

CHECKLIST - DATES - PRESCRIPTIONS

NONFOOD - FROZEN FOOD

FOOD - COLD FOOD

FOOD - SPECIAL STORE LIST

Note that I fill my prescriptions while at the market.

Note that I fill my prescriptions while at the market.

Use a Checklist

I have a eight item checklist for making a grocery list. Note that in a time pinch, I can skip all steps and just shop from my list. These items are only intended as a means to budget.

My budget checklist items:

My budget checklist items:

1. Bring usable bags to the store (saving the planets and earning a $0.05/bag discount at Target, where I usually shop).

2. Check sale flyer.

3. Use a gift card if I have one.

4. Check my text messages for discounts.

5. Use Cartwheel (a Target discount app).

6. Cut coupons and make to grocery list.

7. Use a % off coupon if I have one (available at Target by signing up for pharmacy rewards).

8. Getting my husband's grocery list from him.

Create Priority Codes

2. Check sale flyer.

3. Use a gift card if I have one.

4. Check my text messages for discounts.

5. Use Cartwheel (a Target discount app).

6. Cut coupons and make to grocery list.

7. Use a % off coupon if I have one (available at Target by signing up for pharmacy rewards).

8. Getting my husband's grocery list from him.

Create Priority Codes

A dot means I can wait for a sale or next week, but will need the item soon.

A star means it is a must have item.

These codes help me make decisions in the store about whether to buy today or when the price drops.

Include Extras

A star means it is a must have item.

These codes help me make decisions in the store about whether to buy today or when the price drops.

Include Extras

I have extra things on the list, like special stores that I need to shop at or my prescription list. It helps me see overall what I am buying.

Obey the List

Obey the List

Stick to the list!

I make a few exceptions, like stocking up on kids' gifts when they are on clearance for birthdays and holidays and occasionally buying a ribeye for the freezer when it is on clearance, but mostly, I just buy what is on the list.